Table of Contents

- 2024 TFSA Contribution Limit Misunderstandings

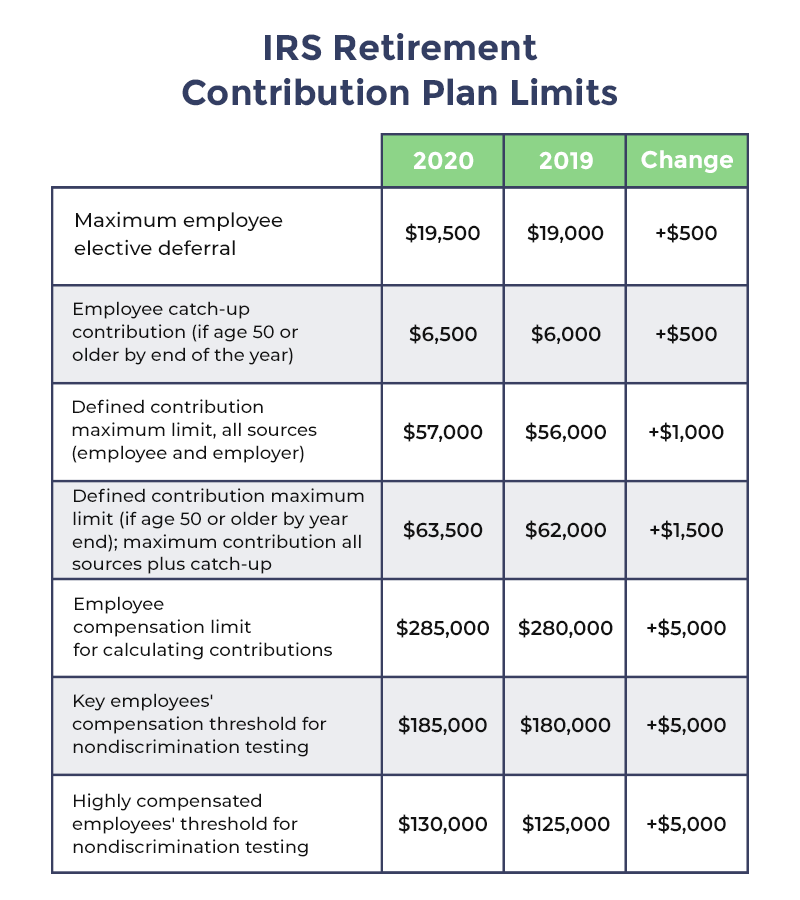

- 2024 401k Max Limit Fidelity - Vitia Karlen

- 2024 - Maximum TSP/401k and IRA contributions - YouTube

- IRS Releases 2024 401(k) Plan Limits, Brandie Barrows

- Tax Changes You Should Know for 2024: 401(k) Limits, Tax Brackets and ...

- Maximum 401k Employee Contribution 2024 - Venus Jeannine

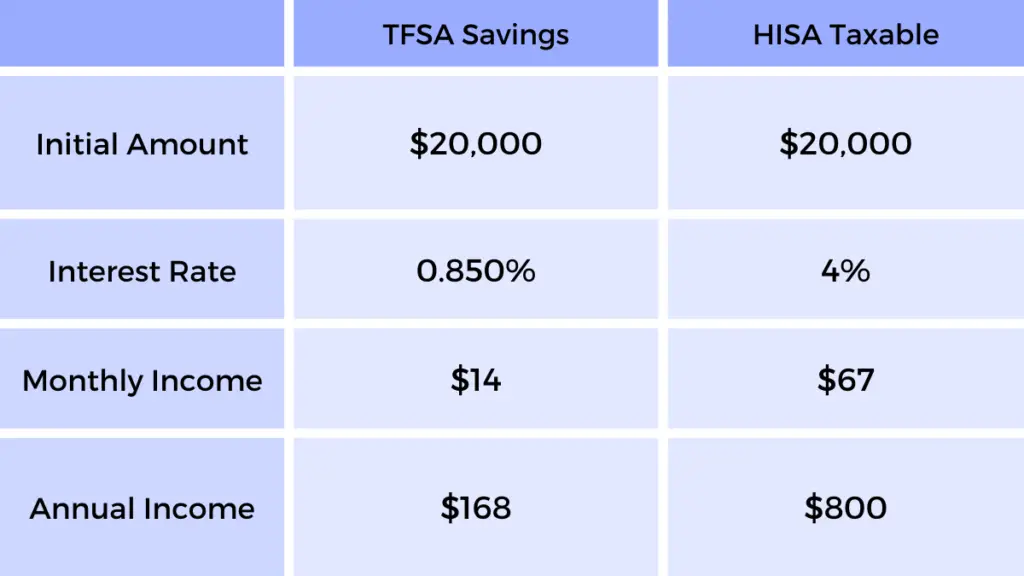

- TFSA Contribution Limit 2024

- A Guide to the 2024 Tax Free Saving Account (TFSA) – Advantage Wealth ...

- 2024 TFSA Contribution Limit Misunderstandings

- 401k Max 2024 Rothman - Chelsy Nanine

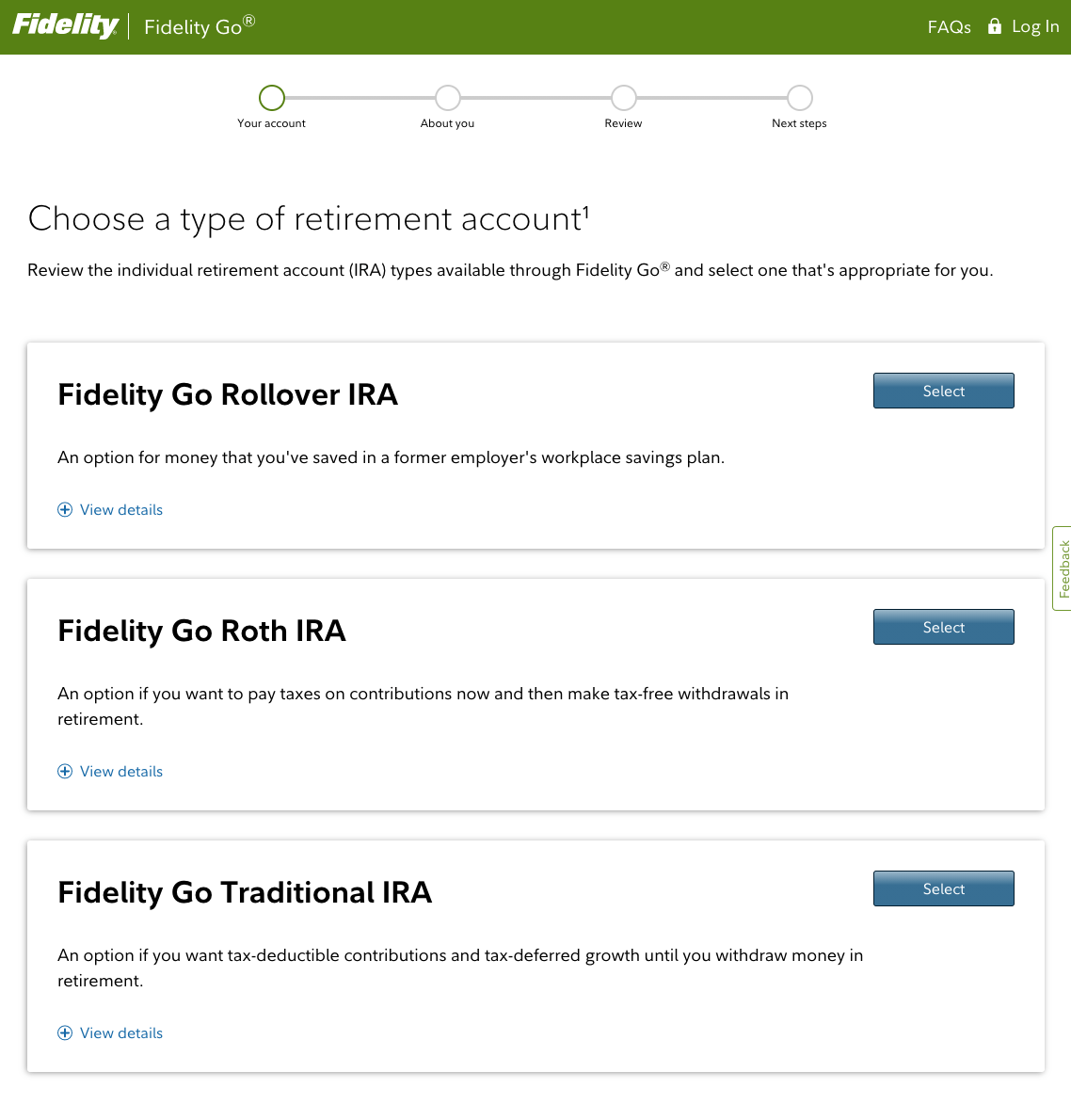

What are 401(k) Roth Catch-up Contributions?

Mandatory 401(k) Roth Catch-up Details

Implications for Employees and Employers

The mandatory 401(k) Roth catch-up details confirmed by the IRS have significant implications for both employees and employers. For employees, the ability to make Roth catch-up contributions can provide a valuable opportunity to save more for retirement and potentially reduce their tax liability in the long run. For employers, the requirement to offer Roth catch-up contributions may necessitate updates to their retirement plans and administrative processes. In conclusion, the IRS confirmation of the mandatory 401(k) Roth catch-up details for 2025 marks an important development in the realm of retirement savings. As employees and employers prepare for this change, it is essential to understand the specifics of the mandatory Roth catch-up contributions and how they can be leveraged to enhance retirement savings. By staying informed and taking proactive steps, individuals can make the most of this opportunity and set themselves up for long-term financial success.For more information on the mandatory 401(k) Roth catch-up details and how they may impact your retirement savings, consult with a financial advisor or tax professional.

Keyword density: - 401(k) Roth catch-up: 1.2% - IRS: 0.8% - Retirement savings: 1.1% - SECURE 2.0 Act: 0.5% - Roth contributions: 0.9% Meta Description: Discover the details of the mandatory 401(k) Roth catch-up contributions confirmed by the IRS for 2025 and how they can impact your retirement savings. Note: The article is written in a way that is easy to understand, and the HTML format is used to make it SEO-friendly. The keyword density is balanced to avoid keyword stuffing, and the meta description provides a brief summary of the article.